The word “revolution” gets thrown at Bitcoin fairly often – but does it stick? Dictionary.com defines a revolution in three different ways:

Definition 1

an overthrow or repudiation and the thorough replacement of an established government or political system by the people governed.

At first glance, definition 1 appears to be fairly wide of the mark, as Bitcoin seeks to replace the world’s monetary systems, rather than any particular political system or government. It could be argued that replacing the current monetary system would have profound political effects however; changes which would certainly alter the role of government.

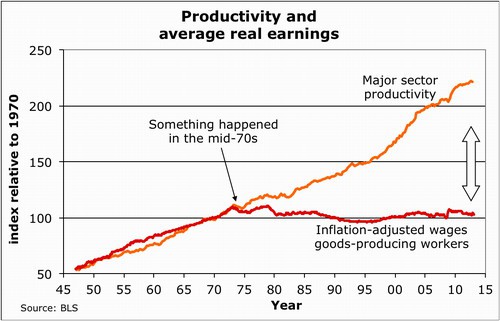

Nixon’s abandonment of the gold standard in 1971 coincided with real wage stagnation. Productivity gains largely accrued to the elite. Welfare increased to maintain stability absent increasing prosperity.

For example, if Bitcoin were the only available form of money, then the government’s ability to deficit spend would be greatly constrained; as in the days of the gold standard. If governments could not borrow fiat against their ability to tax the citizenry, with the option to borrow more fiat to cover any budgetary shortfall, then they certainly wouldn’t run up such massive debts. This would also prevent inflation from raging out of control to destroy the savings of citizens and force them into ever-riskier investments.

Simply put, forcing governments to stay within budget would produce tremendous social changes; if not on par with a revolution then quite likely to spark one! For example, runaway welfare spending would soon become unaffordable, and large segments of the population would be thrown back on their own resources. One can only imagine the type of class warfare likely to result if the various grants and benefits (such as pensions, unemployment, healthcare, etc.) characteristic of social democracy were halted or even diminished.

That said, a return to sound money would see a gradual increase in the prosperity of the lower and middle classes; the less wealthy you are the more inflation affects you. Eventually wage growth should offset any lack of welfare, particularly if a culture of private charity is re-established. The transitionary period between the era of “bread and circuses” (the Roman version of welfare) and the re-emergence of free market capitalism would likely prove chaotic.

Under a Bitcoin-based system of budgetary constraint, it’s also likely that unpopular wars would soon find themselves unfunded; something many would consider an unalloyed positive. Since the advent of deficit spending, governments have been able to wage war long past the point where they’d otherwise be forced to declared bankruptcy and capitulate. Bankers are of course only too happy to lend money to both sides, prolonging the suffering for their financial benefit.

Finally, government’s ability to effectively tax its citizenry would be limited by Bitcoin. Unlike the legacy monetary system, with its ever-increasing level of surveillance and control, Bitcoin offers far greater financial privacy, and cannot be easily-seized. “Not your private keys, not your bitcoin” applies equally to governments and courts as it does to individuals. Under such a system, politicians may find it necessary to effectively represent their voter’s interests, rather than rely on force, if they wish to collect taxes.

So, it’s safe to say that if Bitcoin were to become the new monetary standard, it would lead inevitably and probably quite rapidly to political revolution, for better or worse.

Definition 2

Sociology. a radical and pervasive change in society and the social structure, especially one made suddenly and often accompanied by violence. Compare social evolution.

This definition is a good fit for the phenomenon which is Bitcoin, apart from the mention of violence; Bitcoin is a peaceful revolution. Certainly, the decentralization of money represents a radical shift in the way society is organized. The legacy monetary system is a hierarchical power structure, with central banks at the top controlling monetary issuance, governments and banks below them, followed by corporations, the professional classes, and then everybody else at the base of the “pyramid.”

Bitcoin radically alters this structure. In the early days, anyone from what we might call the “professional classes,” in other words those with the requisite knowledge and wealth, were free to assume the role of the central bank, by issuing money through mining. Bitcoin mining has since become a competitive and capital-intensive industry, but remains open to very rich professionals, corporations, governments and even central banks. However, Bitcoin earnings and investment remain open to pretty much everybody.

Apart from monetary issuance, Bitcoin’s decentralization also dramatically alters the dynamics of social trust. Rather than entrusting central banks to properly control monetary supply (a process which often goes awry, resulting in hyperinflation and other economic catastrophes) and entrusting governments and corporations to manage the financial system, in Bitcoin only open source code is “trusted.” However, for those with the ability to audit this code or at least the state of the Bitcoin network, trust isn’t a requirement; everything can be personally verified. To quote a Bitcoin maxim, “don’t trust, verify.”

As civilization can be said to be founded on trust – we trust people to behave in a cooperative or at least non-hostile manner, and if they don’t we trust the authorities to rectify the situation – shifting trust from people and organizations to objective and transparent code is about as radical a social shift as can be imagined. As the applications of blockchain technology expand from money, the deep-level changes this reallocation of trust will enact will only become more widespread and profound.

Definition 3

a sudden, complete or marked change in something: the present revolution in church architecture.

This third and final definition is the most apt by far. Although cryptographic monetary systems similar to Bitcoin had been proposed in the past (such as Nick Szabo’s Bitgold and Wei Dai’s B-money), Bitcoin represents the first successful cryptocurrency in history.

Beyond the decentralization of trust and control aspects covered above, Bitcoin (and other cryptos) are radically different from any previous forms of money. Whereas digital money is nothing new; indeed most transactions are performed digitally these days, Bitcoin’s fundamental architecture differs markedly from services provided by banks and money transmitters. Bitcoin puts each user in full control of their own finances, with all the advantages and responsibilities which that position implies.

You'll come for the lambos…but stay for the decentralized revolution in individual freedom & financial sovereignty leading to a restructuring of global economics & power & a shift in favor of the people, rights, peace & liberty the likes of which the world has never imagined

— Bruce Fenton (@brucefenton) January 4, 2018

Technical aspects aside, the fact that Bitcoin is deflationary money in a (hyper) inflationary world is a significant departure from the norm – perhaps not fully “revolutionary” as precious metals also fulfill such a role. However, for those who got in at the right time, Bitcoin can certainly be said to have made a revolutionary change to their financial situation!