All the turmoil surrounding GME and Robinhood just goes to show how important it is to ensure our financial self-sovereignty with Bitcoin.

When the clock hit midnight on December 31st, 2020, Gamestop (GME) was just another retailer struggling to keep up its holiday sales amid a raging pandemic. In the month that would follow, the chain of video game stores would return a whopping 1,800%, becoming a symbol of the power shift taking place in the global financial system. The story has led many to explore finance’s inner workings, leaving them with more questions than answers. How exactly did GME pump so hard? Why is Bitcoin such a vital antidote to the current stock market turmoil? And where does Elon Musk, the second-richest man on Earth, fit into the story?

To answer all these questions and more, we’ll start with a much simpler one.

What is a ‘short?’

Almost every account of the stock market’s Manic January refers to the concept of a ‘short squeeze’ as the reason for the sudden rise of GME and similar stocks. While the price of Gamestop has since dropped significantly, the aftereffects of what Goldman Sachs is calling ‘the biggest short squeeze in the last 25 years’ will continue to ripple through global markets for the foreseeable future.

Shorting is a common practice amongst traders who believe that the price of an asset is going down. A short-seller will borrow the asset and immediately sell it on the open market. As is the case when borrowing anything, the short-seller will eventually have to return the asset they borrowed. Should the asset indeed drop, Mr. (or Mrs.) Short will then buy and return it cheaper than the price at which they sold, pocketing the difference as profit. If the asset goes up, Lady (or Lord) Short will have to buy back a more expensive asset and suffer a loss.

This brings us to the first set of actors in our saga—the Hedge Funds.

Hedge funds make a bulk of short selling in the market, and the list of GME short-sellers included some of the largest names on Wall Street. Collectively, the shorting of GME had reached epic proportions.

How epic?

According to market research from IHS Markit Ltd., short interest in the video game retailer hit a peak of 114% in mid-January. That means that for every $1 worth of stock, shorts had borrowed and sold $1.14 worth of GME shares. (To learn more about the dynamics of short selling, check out this article)

But for every seller, there is a buyer. And for every hedge fund manager, there are countless day traders who view their world and their wealth through an entirely different lens. Many of the new players in the stock market are Millennials that came of age during the Great Recession of 2008 and blame the financial crisis squarely on the hedge funds they are now seeking to destroy.

For the new generation of traders, the coordinated effort to pump the price of GME and similar stocks is about more than just money. Through a flurry of TikTok videos, tweets, and conversations on Reddit, these activist-traders laid out their plans for short squeezing GME and similar stocks. Their motive is more than just money. What they want is to inflict pain upon the hedge funds whose actions had ruined the financial universe more than a decade ago. Eventually, millions of these traders would find a collective home on Wall Street Bets, a Reddit forum dedicated to taking down the big hedge funds.

What is a ‘short squeeze?’

Short squeezing can happen to heavily shorted stocks when the price starts to move up against the shorts’ position. An upward movement in the price of a shorted asset puts pressure on the shorts to return the assets they borrowed, known as ‘covering.’

The rush to cover short positions puts more buying pressure on the assets, causing the price to spike even more, which leads to more traders having to cover their shorts, which leads to an even more significant jump. This cycle continues until a large chunk of the short positions is liquidated.

That’s precisely what happened to GME when the initial buying pressure set off a cascading wave of covered shorts and sent the stock price to the sky. The Wall Street Bets army got some help from Tesla, SpaceX, and Neuralink CEO Elon Musk, who has had his fair share of friction with short-sellers himself. Mark Cuban, the owner of the Dallas Maverick and a notable investor, has also championed the Reddit traders’ cause.

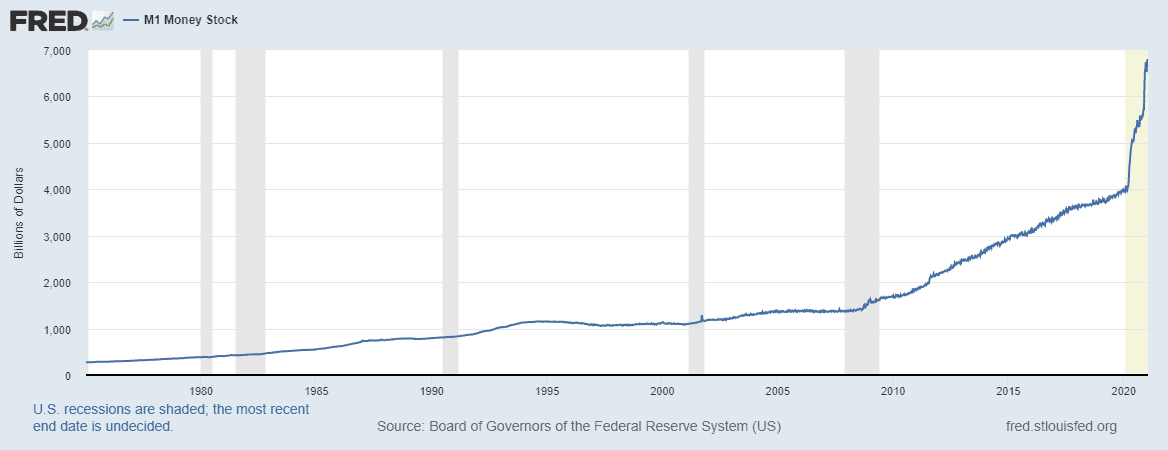

The fact that central banks have infused unprecedented stimulus into the system hasn’t hurt their chances either. President Biden’s proposed $1.9 trillion package promises to double the money supply from what it was pre-COVID9 and unleash a new flow of liquidity on an already stimulated market. All this liquidity creates the perfect macro conditions for an extended short squeeze.

That vertical leap in money supply, coupled with COVID-19 closures, created the perfect environment for the Reddit traders to flourish.

All good times must come to an end

It all began to unravel for GME when Robinhood, the fee-less platform driving a bulk of retail trading in the stock, suddenly suspended buying for several stocks. Many traders lost out due to the chaos that ensued. One such trader was Dave Portnoy. The media personality and Barstools sports owner admitted to losing $700,000 thanks to Robinhood’s actions.

The dramatic event has led many to question the very foundations of finance and discover just how little control they have over their wealth. If Robinhood could suspend trading of GME at the height of its bull run, what other nasty surprises could financial institutions spring up to limit our access to our wealth?

Yet this unfair advantage is not etched into the fabric of the cosmos and does not have to continue forever.

Ten years ago, Bitcoin introduced the world financial self-sovereignty – the idea that you, and only you, have direct control over the wealth you own. No one can seize or freeze your money, and only you get to decide to spend it.

The mascot of a movement: Wall Street Bets is the Reddit forum that kickstarted the entire short squeeze.

Initially championed by a small sect of cryptographers and cypherpunk, Bitcoin’s esteem has spiked over the last year. The same captains of industry who are positioned firmly in the Reddit traders’ camp, like Musk and Cuban, are also rallying for the Bitcoin market to dominate as an asset class.

Look carefully: Who really controls your money?

In recent years, billions of people have experienced first-hand how crucial is the need for financial self-sovereignty.

In 2013, a particularly hard-hit Cyprus had to agree to seize its citizens’ money in exchange for a €10 billion bailout during the Eurozone crisis. Customers of Laiki Bank, Cyprus’ second-largest bank at the time, suffered the most. Over €3.4 billion was drained from customer accounts, even from some that had purchased insurance. Those who had their deposits uninsured were compensated at 6 cents on the dollar – a full six years later.

With the stroke of a pen five years ago, Indian president Narendra Modi abolished the 500 and 1,000 rupee notes, worth about $8 and $15, respectively. While the move was billed as a way to clamp down on corruption in India’s cash-heavy society, banning high-value notes effectively removed 80% of currency from circulation and disrupted all of Indian society.

And then there’s Venezuela, unfortunately, the poster child for monetary mismanagement. In August 2018, Nicholas Maduro’s government devalued the Bolivar in an attempt to stop hyperinflation. Since then, the new Bolivar (Soberano) has hyperinflated dramatically, almost reaching the point before the devaluation when one Soberano was worth 100,000 old Bolivar Fuertes.

Wherever you are in the world, no organization or government can take away your Bitcoin to help pay for a bailout. Your Bitcoin will never be devalued or abolished, and one Bitcoin will always equal one Bitcoin.

The rise and rise of Decentralized Finance

“Long Bitcoin, Short the Bankers” has become the mantra for the new generation seeking to replace the breach of trust and rigged odds of the current setup with a decentralized financial system built on inclusive, transparent networks. Furthermore, Bitcoin is not limited to any single jurisdiction like many typical financial products, giving people worldwide the opportunity to participate in wealth creation and preservation.

But that’s not all. What started with Bitcoin has since grown into a multi-billion dollar alternative financial system that is more inclusive, transparent, and fair than Wall Street. With decentralized finance, or DeFi for short, users can save, borrow and trade directly with their peers without going through any institutions in the middle. These include exchanges such as Uniswap and Mirror Finance which allow anybody to list an asset that no single entity can then take down.

Remember how the unfortunate Robinhood traders all of a sudden found themselves unable to trade stock?

That wouldn’t happen on an open-source, peer-to-peer decentralized exchange.

A peaceful revolution

The movement that is bringing Bitcoin to the forefront of international consciousness does not carry the guns and violence of flesh-and-blood revolutionaries. Instead, it fights through memes and ideas that catch fire around the world within moments.

Bitcoin offers the financial self-sovereignty that investors are looking for after the past week’s market turmoil. For the first time in history, buying Bitcoin and having control of your private key, a secret digital signature that allows you to spend your Bitcoin, puts you in full control of your wealth.

Whether it’s your first ever Bitcoin or even if you’ve been stacking for a while, buy easily and securely on Coinmama in any one of our 188 supported countries.